Forensic Accounting UAE: Protect Your Small Business from Financial Fraud

In today’s dynamic business landscape, financial transparency and integrity are essential for every business, especially small businesses in the UAE. Small businesses, while growing, can become targets for financial fraud, embezzlement, and other irregularities. Here’s where forensic accounting becomes crucial, providing a reliable safeguard for your business.

What is Forensic Accounting UAE?

Forensic accounting UAE is a specialized area of accounting that combines traditional accounting methods with investigative skills to uncover and resolve financial crimes and irregularities. It involves an in-depth review of financial statements, transactions, and other financial records to detect fraud, theft, misappropriation, or other misconduct.

In recent years, forensic accounting UAE has become increasingly important due to evolving business complexities, regulatory requirements, and heightened awareness of financial security among business owners.

Why Do Small Businesses Need Forensic Accounting UAE?

Fraud Detection and Prevention

Small businesses often lack robust internal controls, making them easy targets for fraudsters. Forensic accounting UAE helps businesses identify vulnerabilities, prevent fraud, and implement strong financial controls to secure their assets.

Dispute Resolution

Financial disputes frequently arise among business stakeholders. Forensic accounting UAE provides impartial analysis, detailed documentation, and credible insights that are vital for resolving financial disputes involving partners, vendors, or employees.

Legal Compliance

Compliance with financial regulations is mandatory in the UAE. Forensic accounting UAE ensures your business meets regulatory standards, helping avoid penalties, fines, and legal complications.

Asset Recovery

Recovering stolen or misappropriated assets is challenging. Forensic accounting UAE specialists are trained in tracking and recovering lost assets, protecting your business from significant financial loss.

Insurance Claims

Businesses that experience fraud or theft may need forensic accounting UAE services to prepare thorough documentation and evidence required for successful insurance claims.

How Does Forensic Accounting UAE Work?

The forensic accounting process in the UAE typically involves:

Initial Consultation

Understanding your business operations and identifying potential vulnerabilities to fraud.

Data Collection and Analysis

Reviewing financial documents, including statements, ledgers, bank records, and transactions, to detect irregularities or fraud.

Investigation

Conducting interviews and detailed examination of internal controls, financial practices, and business operations to uncover fraud or financial misconduct.

Reporting

Providing clear, concise, and detailed reports summarizing investigative findings and recommendations for action.

Legal Support

Assisting with legal proceedings by providing expert witness testimony and documented evidence when required.

Choosing the Right Forensic Accounting UAE Service

Selecting a reliable forensic accounting UAE provider is essential. Consider the following:

- Experience and Expertise: Choose a forensic accountant with significant experience in handling small business cases and proven success in fraud detection.

- Reputation: Work with reputable firms known for integrity, confidentiality, and trustworthiness.

- Clear Communication: Opt for firms that deliver transparent, easy-to-understand reporting and remain accessible for consultations.

- Customized Solutions: Ensure the forensic accounting firm understands your specific business needs and offers tailored solutions.

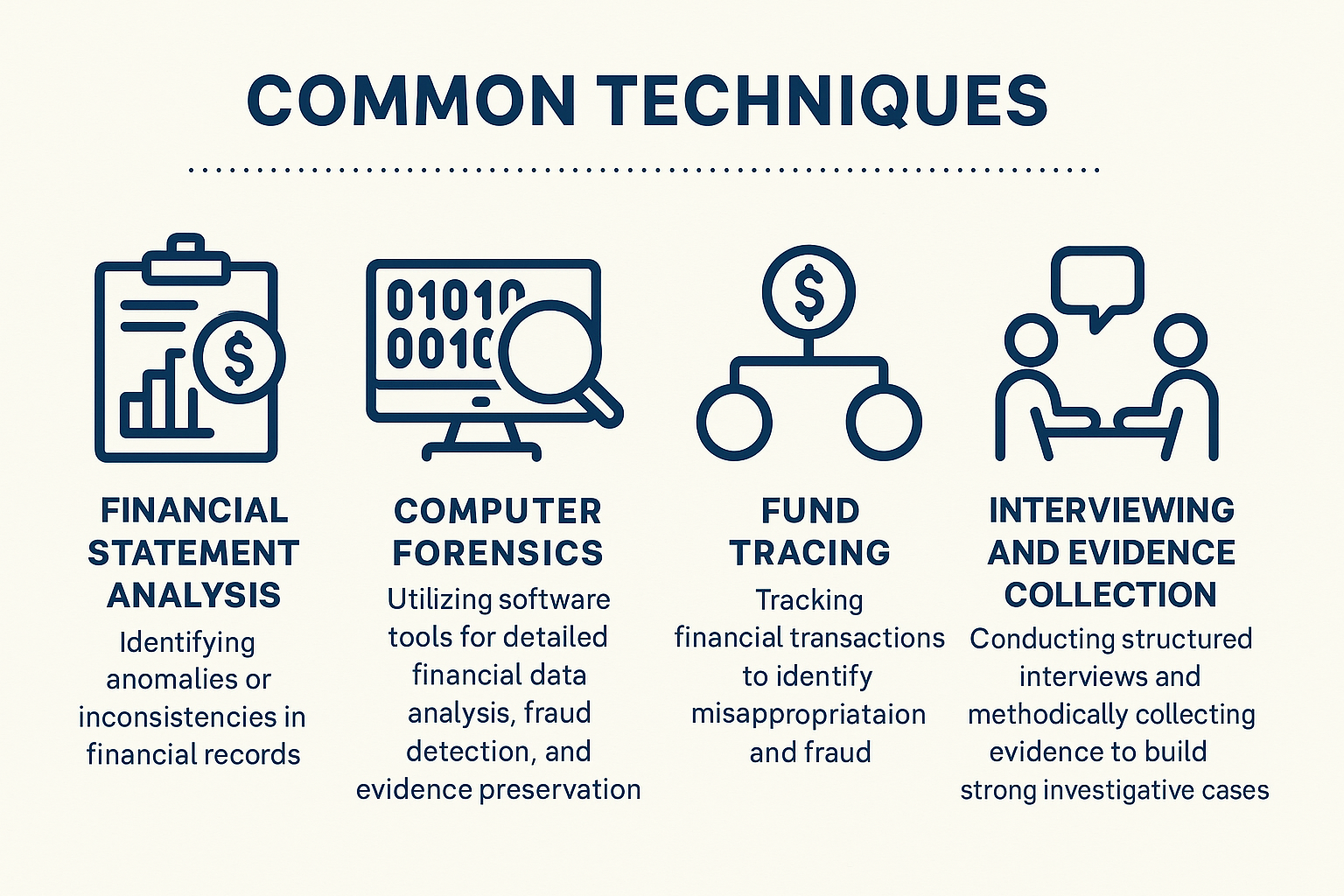

Common Techniques Used in Forensic Accounting UAE

- Financial Statement Analysis: Identifying anomalies or inconsistencies in financial records.

- Computer Forensics: Utilizing software tools for detailed financial data analysis, fraud detection, and evidence preservation.

- Fund Tracing: Tracking financial transactions to identify misappropriation and fraud.

- Interviewing and Evidence Collection: Conducting structured interviews and methodically collecting evidence to build strong investigative cases.

Frequently Asked Questions About Forensic Accounting UAE

Q1. What types of businesses benefit from forensic accounting UAE?

All businesses, particularly small businesses prone to fraud or irregularities, benefit significantly from forensic accounting services.

Q2. How long does a forensic accounting investigation typically take?

The investigation duration varies based on complexity, ranging from a few weeks to several months.

Q3. Is forensic accounting affordable for small businesses?

While costs vary, investing in forensic accounting services typically saves businesses from larger losses associated with undetected fraud.

Q4. Can forensic accountants testify in UAE courts?

Yes, forensic accountants provide expert witness testimony and support legal cases with their findings in UAE courts.

Contact JASM Accounting for Forensic Accounting UAE Services

At JASM Accounting, we specialize in forensic accounting UAE services, dedicated to protecting small businesses from financial irregularities and fraud. Our expert team combines extensive financial knowledge with investigative skills to secure your business’s financial health.

Ensure your business remains secure and compliant. Contact JASM Accounting today for expert forensic accounting services.